Table of Content

- Personal Loans

- What Do I Need to Get a Home Improvement Loan?

- Pag Ibig Housing Loan Requirements And Documents Needed

- Can I Get An Emergency Loan With Bad Credit

- Pagibig Fund Housing Loan Affordability Calculator

- Pag Ibig Housing Loan : Form Requirements Calculator Application

- Cash-out refinance – Best for when mortgage rates are low

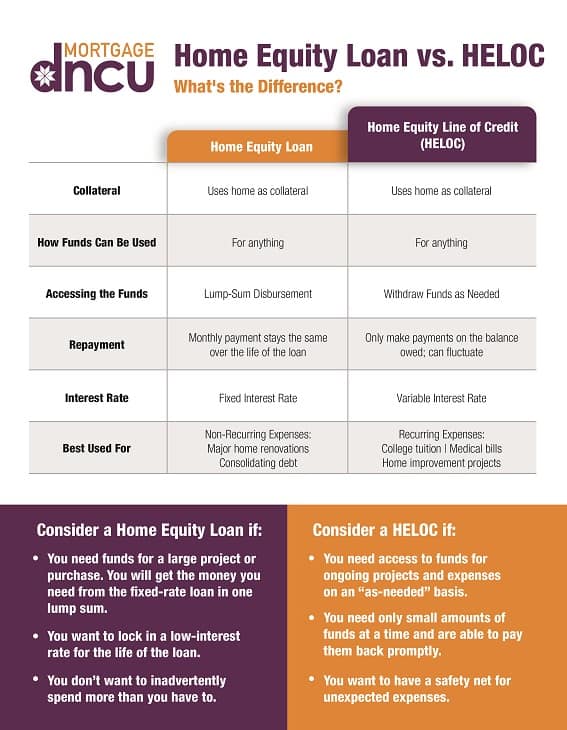

Home equity loansare another type of loan that’s commonly used to pay for home renovations. As a type of secured loan, home equity loans use the equity you have in your house as collateral for the loan. This means that if you default on the loan, your lender legally can take your home away from you.

It includes vacation or second homes and rental properties; multifamily as well as one-to-four-family structures; individual condominium and cooperative units; and manufactured and mobile homes. It excludes recreational vehicles such as boats and campers, and transitory residences such as hotels, hospitals, and college dormitories. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

Personal Loans

You should get your funds within 7 business days after being approved. In situations where an acquisition or merger has occurred, please Contact Us for assistance on determining the RID number and agency code. The data in question do not agree with an expected standard . Review for correctness and change only if erroneous data has been reported. An example is reported income that is less than or equal to $9 thousand.

Many personal loan lenders market their products specifically for paying for home improvement projects. Home equity line of credit — A HELOC is also secured by your property, but it works more like a credit card. You can borrow against your line of credit as needed during a set period of time, known as the draw period. The interest-free period often only lasts for a certain time, so you’ll need to pay it off before the period ends.

What Do I Need to Get a Home Improvement Loan?

Loans with an FHA guarantee protect lenders against potential loss and ease qualification requirements for the borrower. Instead of looking solely at traditional metrics, lenders also evaluate your income and verify your employment. The maximum loan amount is $60,000, and loan terms are capped at 20 years. FHA 203 loans can go as low as 500, while VA and USDA loans do not have minimum credit score requirements. One specific type of credit card that may be helpful for home improvements in some cases is a store credit card. These credit cards are usually issued by large stores such as Lowe's, Home Depot, IKEA, Walmart, etc.

Also, input the name, address, city, state and zip code of any parent company. Nondepository institutions of all agencies, except HUD , must provide parent information. However, if any HUD reporters have a parent, they too must provide the parent company information.

Pag Ibig Housing Loan Requirements And Documents Needed

That’s a significant benefit, according to Jacob Channel, senior economic analyst with LendingTree. If you don't want your mortgage or equity tied to your home improvement expenses, an unsecured personal loan is a great option to consider. Personal loans for home improvements offer quick funding, don't require any collateral and have relatively low credit requirements. Below is a list of some of the easiest personal loans to get for home improvements. Because a home equity loan is similar to having a second mortgage on your house, it’s also a bit trickier to get than a personal loan.

You can expect to be able to borrow up to 85% of your home equity, according to the Federal Trade Commission. If you have $50,000 of equity, that means you’re generally limited to borrowing up to $42,500. So if you don’t have much equity in your home—perhaps because your property value dropped, or you just started paying back a mortgage—you may not be able to borrow much, if anything. Everyone could pay for home improvements in cash in an ideal world, but repairs are often so expensive that a loan is the only option. If repairs are necessary and you plan on living there for many years, then yes, consider taking out a home improvement loan.

Cash-out refinance — With a cash-out refinance, you take out a new mortgage for a higher amount than you currently owe. Your new mortgage pays off and replaces the one you currently have, and the difference in the two amounts come to you as cash that you can use for any purpose, including fixing up your home. Consider though, that you'll be paying your mortgage off over a longer term - along with interest rates. You could also be charged if you want to pay off the loan early. If you don’t make your repayments, you could receive a fine.

In-depth research determine where and how companies may appear. Historical Mortgage Rates A collection of day-by-day rates and analysis. You must check the box to agree to the terms and conditions.

The two most common types of home improvement loans are unsecured and secured. To get secured home improvement loans you need to put up collateral, such as your home equity or the value of your property. Unsecured home improvement loans are not backed by any collateral and tend to have higher interest rates than secured loans. Most home improvement lenders allow you to apply online in just a few minutes and get a decision nearly instantaneously. Some types of home equity loans require an appraisal and closing costs, and can take 30 days or more to close. In addition to conventional home improvement loans, you may also be eligible for a low-interest home improvement loan or a grant through the U.S.

To choose the best home improvement loan, examine your financial situation – your credit report, credit score, credit history, debt-to-income ratio, mortgage equity, and income. Determine the cost of your home improvement project, what funding options you qualify for, and compare lenders to find the lowest rates. Are you willing to put your home as collateral, or do you prefer an unsecured personal loan? Our guide on how to get a home improvement loan can help you get started on your loan application. Home improvement loans are a fiscally prudent way to finance major remodeling projects. Unlike credit cards or personal loans, home improvement loans come with fixed interest rates.

You can use the funds from these borrowing methods for almost anything. Keep in mind that home equity loans require you to use your home as collateral. This is reported for originated loans and for loan applications that do not result in an origination.

Eligibility requirements are different for every county, as well. These are the best personal loans for home improvement from our partners. They offer low fees, large loan amounts and low minimum APRs. "NA" is also used for loans to an institution's employees to protect their privacy. There are a lot of things to consider, such as how much more you’ll pay in interest over time with the new loan and whether you can afford the new payments. But for some people, it’s a good way to get the money they need for home improvements.

Pre-qualifying shows you your approval odds and what rates may be available to you. If you sell a loan in the same calendar year in which it was originated or purchased, you must identify the type of purchaser to whom it was sold. If the loan is sold to more than one purchaser, use the code for the entity purchasing the greatest interest. If you sell only a portion of the loan, retaining a majority interest, do not report the sale.

No comments:

Post a Comment